The Grey Market Premium (GMP) for the Fujiyama Power Systems IPO has now begun trading. Keep track of the latest GMP, Kostak, and Subject-to-Sauda rates for the most current market indications.

The Grey Market Premium (GMP) for the Fujiyama Power IPO fluctuated between ₹2 on November 18th and a high of ₹3 on November 19th.

Track Fujiyama Power Systems IPO GMP and Kostak rates daily.

| Date | IPO GMP | GMP Trend | Gain |

| 19 Nov | ₹3 | 1.31% | |

| 18 Nov | ₹2 | 0.87% |

Fujiyama Power Systems IPO Timeline

| IPO Open Date: | November 13, 2025 |

| IPO Close Date: | November 17, 2025 |

| Basis of Allotment: | November 18, 2025 |

| Refunds: | November 19, 2025 |

| Credit to Demat Account: | November 19, 2025 |

| IPO Listing Date: | November 20, 2025 |

| IPO Bidding Cut-off Time: | November 17, 2025 – 5 PM |

Fujiyama Power Systems IPO Details

| IPO Open Date | November 13, 2025 |

| IPO Close Date | November 17, 2025 |

| Face Value | ₹1 Per Equity Share |

| IPO Price Band | ₹216 to ₹228 Per Share |

| Issue Size | Approx ₹828 Crores |

| Fresh Issue | Approx ₹600 Crores |

| Offer for Sale: | Approx 1,00,00,000 Equity Shares |

| Issue Type | Book Built Issue |

| IPO Listing | BSE, NSE |

About the Business

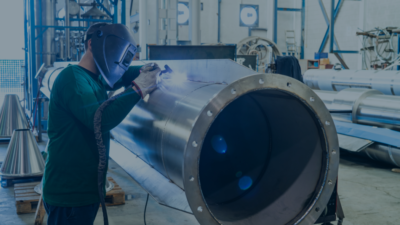

Established in 2017, Fujiyama Power Systems Limited is a prominent manufacturer and integrated solutions provider in the rooftop solar sector, specializing in the production of on-grid, off-grid, and hybrid solar inverters. The company markets its products under two respected brands: the long-standing UTL Solar, with a 29-year legacy, and Fujiiyama Solar, both of which have established a strong reputation in the industry. Fujiyama has further expanded its global footprint by exporting to markets including the USA, Bangladesh, and the UAE.

A key differentiator is its advanced product portfolio, which includes specialized items like Single-card Online UPS, Combo UPS with AVR, High-frequency online UPS, and single-card SMT inverters, positioning Fujiyama as one of the few Indian companies capable of developing such sophisticated technology. This extensive reach is supported by a robust distribution and service infrastructure comprising over 725 distributors, 5,546 dealers, and 1,100 exclusive retail partners. The company’s commitment to customer-specific solutions is reinforced by a dedicated team of more than 602 qualified service engineers, trained to deliver customized solar systems.